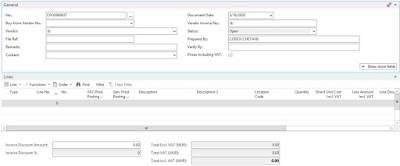

Today we will learn how to configure purchase & payable setup.

Step 1:

Main Menu --> Department --> Financial Management --> Payables --> Setup --> Purchase & Payable Setup

Step 2:

Fill all the necessary information.

| General | |

| Discount Posting | Choose the type of discount posting |

| Receipt on Invoice | If you want to do receipt on invoice |

| Return Shipment on Credit Memos | If you want to do return shipment on credit memo |

| Invoice Rounding | Allow rounding amounts in invoice |

| Create item from item no. | Allow creating of item from item no |

| Ext. Doc. No. Mandatory | Make external document number mandatory |

| Allow VAT Difference | Allow vat difference |

| Calc. Inv. Discount | Calculate discount on invoices |

| Calc. Inv. Disc. Per VAT ID | Calculate discount on invoices per vat group |

| Appln. Between Currency | Choose the type of application for currencies |

| Copy Comments Blanket Order | Allow copy comment when creating blanket order |

| Copy Comments Order to Invoice | Allow copy comment order when creating invoice |

| Copy Comments Order to Receipt | Allow copy comment order when doing receipting |

| Copy Cmts Ret. Ord to Cr. Memos | Allow copy comment return order to credit memos |

| Copy Cmts Ret. Ord to Ret. Shpt | Allow copy comment return order to return shipment |

| Exact Cost Reversing Mandatory | Allow to reverse the exact cost |

| Check Prepmt. when posting | Check if pre-payment is done before posting |

| Prepmt. Auto update frequency | Choose the frequency for update of pre-payment |

| Default Posting Date | Choose which date to take as posting date |

| Default Qty. to receive | Choose the default quantity for receive |

| Allow Document Deletion Before | If you want to put a restriction to prevent any deletion of document |

| TDS Posting Account | Choose the G/L Account to post TDS |

| VAT % | Enter the legal VAT percentage on transaction |

| Ignore Updated Addresses | If you want to ignore any updated addresses |

| Number Series | |

| Vendor Nos | Enter the no series to create vendor |

| Quote Nos | |

| Blanket Order Nos | |

| Order Nos | |

| Return Nos | |

| Invoice Nos | |

| Posted Invoice Nos | |

| Credit Memo Nos | |

| Posted Credit Memo Nos | |

| Posted Receipt Nos | |

| Posted Return Shipment Nos | |

| Posted Prepmt. Inv Nos | |

| Posted Prepmt. Cr. Memo. Nos | |

| Background Posting | |

| Post with Job Queue | |

| Post & Print with Job Queue | |

| Job Queue Category Code | |

| Notify on Success | |

Archiving

| |

| Archive Quote | Enter if to archive quote |

| Archive Orders | Allow archive orders |

| Archive Blanket Orders | Allow archive blanket orders |

| Archive Return Orders | Allow archive return orders |

Default Accounts

| |

| Default Debit Account for Non-Item Lines | Enter G/L Account to debit non-item line |

| Default Credit Account for Non-Item Lines | Enter G/L Account to credit non-item line |

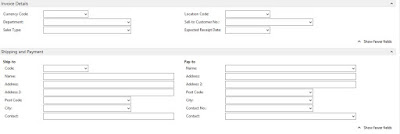

| Procurement | |

| Prepare By | Enter the prepared by name to display on purchase order |

| Authorize By | Enter the Authorize By name to display on purchase order |

| Phone No | Enter Phone Number to display on purchase order |

| Fax No | Enter Fax number to display on purchase order |

| Enter Email to display on purchase order | |

| Bank Letter | |

| Bank Letter Sign | Enter the person name on bank letter |

| Bank Letter Sign Title | Enter the title of the person on bank letter |

| Bank Letter Sign 1 | Enter a second person name on bank letter |

| Bank Letter Sign 1 Title | Enter the title of the person on bank letter |

| Bank Letter Sign 2 | Enter a third person name on bank letter |

| Bank Letter Sign 2 Title | Enter the title of the person on bank letter |

Click on OK to close.